This International Women’s Day it is important to reflect on how far we have come in terms of addressing the gender pension gap, as well as acknowledging and educating ourselves on what we can do to continue to close the gap. Scottish Widows have recently launched a campaign exploring the gender pension gap further and reported on average women are retiring with £123,000 less in their pension than men.

The same report estimates that the average 25 year old woman is on track to retire with £100,000 less than a man. Translating into additional 18 working years to reach the same level of pension. This sobering statistic highlights the fact that, without action, today’s Generation Z, will be suffering the same challenges as women retiring today.

Ultimately, the gap is difficult to fix, with many factors, small and large contributing to the overall picture. And this is before we consider the current cost of living crisis or the mountainous task of saving for a house deposit affecting both men and women.

Grit, resilience and aptitude are characteristics I witness in abundance in women, and these are superpowers when it comes to achieving long term goals. We’re a dab hand in transitioning screaming toddlers into productive young adults and given the opportunity to turn some of our focus and household spend towards building our own long term financial security, I’m confident we can make strides towards shrinking the pension gap and here’s how:

Getting Smart With The Money We Have

1. The power of habits

One of simplest yet most powerful tips I give to people is to save regularly and start today. Whether it’s £5 or £500 a month, the long term benefits of building a savings habit are huge. No amount is too small. Once a regular savings pattern is established, the amounts being saved each month can be gradually increased.

In my experience, those who start with smaller, more affordable sums each month are less likely to need to break into their savings leading to a stronger, more fruitful savings habit.

2. The importance of saving early

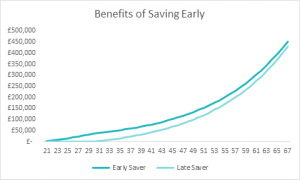

Leveraging the power of compound interest is relevant to all long-term savers but particularly to those in their 20s. A young woman saving for 10 years between age 20 and 30 will need to save around 70% less than someone delaying starting to save until their 30’s to achieve the same pot of money when they reach retirement. *

*Assumes ‘early saver’ saves £2,500 every year from ages 20-30 and ‘late saver’ saves £2,500 ever year from age 30-70. Both grow at 7% pa and retire at age 67.

3. Use of Tax-Free Allowances

Pensions and Lifetime ISA’s both come with attractive tax allowances which will boost the value of savings over the long term. Parents at home caring for young children can save up to £6,880** per year which will receive an immediate 25% boost to £8,600 and savings will grow tax free.

This might not be affordable to all, however, for families with some surplus income where one partner is working and the other caring for the family, this is a highly effective way of continuing to build the long-term financial security of both.

For parents and grandparents with surplus capital or income wanting to pass on wealth, supporting your daughters and granddaughters to use these allowances can have a profound impact on their long-term financial health.

What Financial Planning Won’t Fix

What effective planning won’t fix is the structural imbalances in the labour market that are highlighted in the report. This is a problem for society to reflect upon. At this point in time, women, on average, are paid less and are more likely to work part time and take breaks in employment. All this leads to women saving less.

The £123,000 difference in pension pots at retirement seems even more unjust when you put it in the context the amount of unpaid work women do caring for children and the vulnerable in society. The archetypes of man going to work to provide and women staying at home to care for the family stubbornly persists.

On a personal level I am encouraged to see families starting to tread their own paths and making different decisions and breaking free of some of the social norms, sharing both the caring and providing responsibilities.

Some work has been done in the workplace to support women, however, systemic change is needed and I believe this means a shift in attitudes and a new look workplace that supports all employees, male, female or other, to be parents. The status quo humours, rather than empowers, working parents. It provides what is legally required, and sometimes with a degree of resentment.

The recent hit series Motherland (written by the immensely talented Sharon Horgan) so accurately hits on some many of the challenges and faced by stay-at-home parents with ‘Kevin’ the token stay at home dad being depicted as… well a bit of an anxious, weedy mess.

I’d love to see a society which encourages and facilitates both parents to work part time without limiting their earning or career potential. Instead of one parent working 5 days in a high earning role and the other 2 days in low paid work, opportunities open up for both to work 3-4 days per week and with the same access to building a successful career.

All the time that taking on caring responsibilities directly leads to lower power, status and earnings potential, asking men to pick up a greater share is going to be a hard sell. If we can change this, then I believe we will see better outcomes for women throughout their working lives and in retirement.

Let’s continue to talk, research and educate ourselves and others about this topic past International Women’s Day!

** For further information on eligibility criteria for LISA’s https://www.moneyhelper.org.uk/en/savings/types-of-savings/a-guide-to-lifetime-isas

For further information on eligibility criteria for pensions savings https://www.moneyhelper.org.uk/en/pensions-and-retirement/tax-and-pensions/the-annual-allowance

Anything mentioned in this article is not a personalised recommendation. The article is intended for information only to raise awareness. Your personal circumstances will dictate what is right for you. If you are unsure always seek advice before proceeding with any investment.

Annette Hender

Partner and Chartered Financial Planner